EX-10.1

Published on August 12, 2025

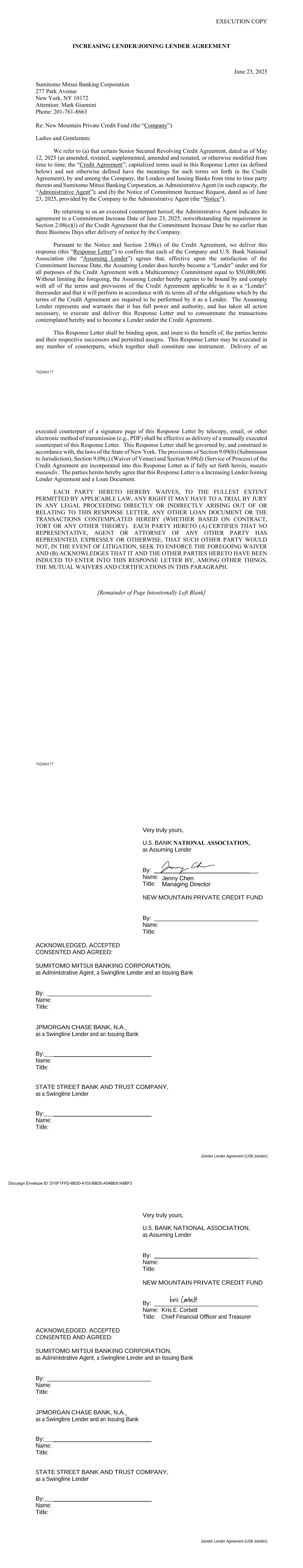

EXECUTION COPY 782668177 INCREASING LENDER/JOINING LENDER AGREEMENT June 23, 2025 Sumitomo Mitsui Banking Corporation 277 Park Avenue New York, NY 10172 Attention: Mark Giannini Phone: 201-761-8663 Re: New Mountain Private Credit Fund (the “Company”) Ladies and Gentlemen: We refer to (a) that certain Senior Secured Revolving Credit Agreement, dated as of May 12, 2025 (as amended, restated, supplemented, amended and restated, or otherwise modified from time to time, the “Credit Agreement”; capitalized terms used in this Response Letter (as defined below) and not otherwise defined have the meanings for such terms set forth in the Credit Agreement), by and among the Company, the Lenders and Issuing Banks from time to time party thereto and Sumitomo Mitsui Banking Corporation, as Administrative Agent (in such capacity, the “Administrative Agent”); and (b) the Notice of Commitment Increase Request, dated as of June 23, 2025, provided by the Company to the Administrative Agent (the “Notice”). By returning to us an executed counterpart hereof, the Administrative Agent indicates its agreement to a Commitment Increase Date of June 23, 2025, notwithstanding the requirement in Section 2.08(e)(i) of the Credit Agreement that the Commitment Increase Date be no earlier than three Business Days after delivery of notice by the Company. Pursuant to the Notice and Section 2.08(e) of the Credit Agreement, we deliver this response (this “Response Letter”) to confirm that each of the Company and U.S. Bank National Association (the “Assuming Lender”) agrees that, effective upon the satisfaction of the Commitment Increase Date, the Assuming Lender does hereby become a “Lender” under and for all purposes of the Credit Agreement with a Multicurrency Commitment equal to $50,000,000. Without limiting the foregoing, the Assuming Lender hereby agrees to be bound by and comply with all of the terms and provisions of the Credit Agreement applicable to it as a “Lender” thereunder and that it will perform in accordance with its terms all of the obligations which by the terms of the Credit Agreement are required to be performed by it as a Lender. The Assuming Lender represents and warrants that it has full power and authority, and has taken all action necessary, to execute and deliver this Response Letter and to consummate the transactions contemplated hereby and to become a Lender under the Credit Agreement. This Response Letter shall be binding upon, and inure to the benefit of, the parties hereto and their respective successors and permitted assigns. This Response Letter may be executed in any number of counterparts, which together shall constitute one instrument. Delivery of an 782668177 executed counterpart of a signature page of this Response Letter by telecopy, email, or other electronic method of transmission (e.g., PDF) shall be effective as delivery of a manually executed counterpart of this Response Letter. This Response Letter shall be governed by, and construed in accordance with, the laws of the State of New York. The provisions of Section 9.09(b) (Submission to Jurisdiction), Section 9.09(c) (Waiver of Venue) and Section 9.09(d) (Service of Process) of the Credit Agreement are incorporated into this Response Letter as if fully set forth herein, mutatis mutandis. The parties hereto hereby agree that this Response Letter is a Increasing Lender/Joining Lender Agreement and a Loan Document. EACH PARTY HERETO HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS RESPONSE LETTER, ANY OTHER LOAN DOCUMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THIS RESPONSE LETTER BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS PARAGRAPH. [Remainder of Page Intentionally Left Blank] Joinder Lender Agreement (USB Joinder) Very truly yours, U.S. BANK NATIONAL ASSOCIATION, as Assuming Lender By: ___________________________________ Name: Title: NEW MOUNTAIN PRIVATE CREDIT FUND By: ___________________________________ Name: Title: ACKNOWLEDGED, ACCEPTED CONSENTED AND AGREED: SUMITOMO MITSUI BANKING CORPORATION, as Administrative Agent, a Swingline Lender and an Issuing Bank By: ___________________________________ Name: Title: JPMORGAN CHASE BANK, N.A.¸ as a Swingline Lender and an Issuing Bank By: _________________________________ Name: Title: STATE STREET BANK AND TRUST COMPANY, as a Swingline Lender By: _________________________________ Name: Title: Jenny Chen Managing Director Joinder Lender Agreement (USB Joinder) Very truly yours, U.S. BANK NATIONAL ASSOCIATION, as Assuming Lender By: ___________________________________ Name: Title: NEW MOUNTAIN PRIVATE CREDIT FUND By: ___________________________________ Name: Kris E. Corbett Title: Chief Financial Officer and Treasurer ACKNOWLEDGED, ACCEPTED CONSENTED AND AGREED: SUMITOMO MITSUI BANKING CORPORATION, as Administrative Agent, a Swingline Lender and an Issuing Bank By: ___________________________________ Name: Title: JPMORGAN CHASE BANK, N.A.¸ as a Swingline Lender and an Issuing Bank By: _________________________________ Name: Title: STATE STREET BANK AND TRUST COMPANY, as a Swingline Lender By: _________________________________ Name: Title: Docusign Envelope ID: D10F1FFD-8B3D-4103-B8D5-A54BE81A8BF3

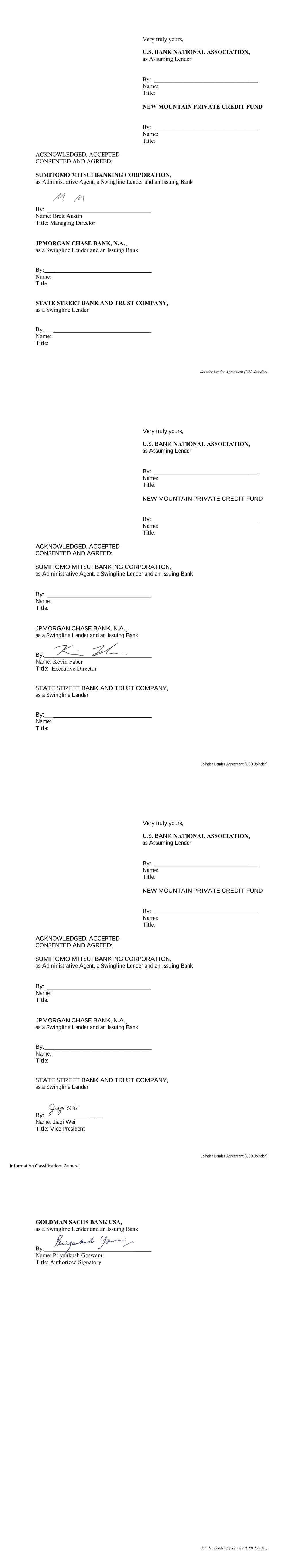

Joinder Lender Agreement (USB Joinder) Very truly yours, U.S. BANK NATIONAL ASSOCIATION, as Assuming Lender By: ___________________________________ Name: Title: NEW MOUNTAIN PRIVATE CREDIT FUND By: ___________________________________ Name: Title: ACKNOWLEDGED, ACCEPTED CONSENTED AND AGREED: SUMITOMO MITSUI BANKING CORPORATION, as Administrative Agent, a Swingline Lender and an Issuing Bank By: ___________________________________ Name: Brett Austin Title: Managing Director JPMORGAN CHASE BANK, N.A.¸ as a Swingline Lender and an Issuing Bank By: _________________________________ Name: Title: STATE STREET BANK AND TRUST COMPANY, as a Swingline Lender By: _________________________________ Name: Title: Joinder Lender Agreement (USB Joinder) Very truly yours, U.S. BANK NATIONAL ASSOCIATION, as Assuming Lender By: ___________________________________ Name: Title: NEW MOUNTAIN PRIVATE CREDIT FUND By: ___________________________________ Name: Title: ACKNOWLEDGED, ACCEPTED CONSENTED AND AGREED: SUMITOMO MITSUI BANKING CORPORATION, as Administrative Agent, a Swingline Lender and an Issuing Bank By: ___________________________________ Name: Title: JPMORGAN CHASE BANK, N.A.¸ as a Swingline Lender and an Issuing Bank By: _________________________________ Name: Kevin Faber Title: Executive Director STATE STREET BANK AND TRUST COMPANY, as a Swingline Lender By: _________________________________ Name: Title: Joinder Lender Agreement (USB Joinder) Information Classification: General Very truly yours, U.S. BANK NATIONAL ASSOCIATION, as Assuming Lender By: ___________________________________ Name: Title: NEW MOUNTAIN PRIVATE CREDIT FUND By: ___________________________________ Name: Title: ACKNOWLEDGED, ACCEPTED CONSENTED AND AGREED: SUMITOMO MITSUI BANKING CORPORATION, as Administrative Agent, a Swingline Lender and an Issuing Bank By: ___________________________________ Name: Title: JPMORGAN CHASE BANK, N.A.¸ as a Swingline Lender and an Issuing Bank By: _________________________________ Name: Title: STATE STREET BANK AND TRUST COMPANY, as a Swingline Lender By: __ __ Name: Jiaqi Wei Title: Vice President Joinder Lender Agreement (USB Joinder) GOLDMAN SACHS BANK USA, as a Swingline Lender and an Issuing Bank By: _________________________________ Name: Priyankush Goswami Title: Authorized Signatory